Where does the EU stand PropTech-wise?

PropTech1, a Berlin-based venture capital fund focusing on technological solutions for real-estate innovation, just released its “European PropTech Trends 2020” report showing that – PropTech-wise – things are going well for the continent. Read on for the report’s key findings.

(Russia and Turkey are excluded, as well as trends such as co-living and co-working due to their minor technological importance).

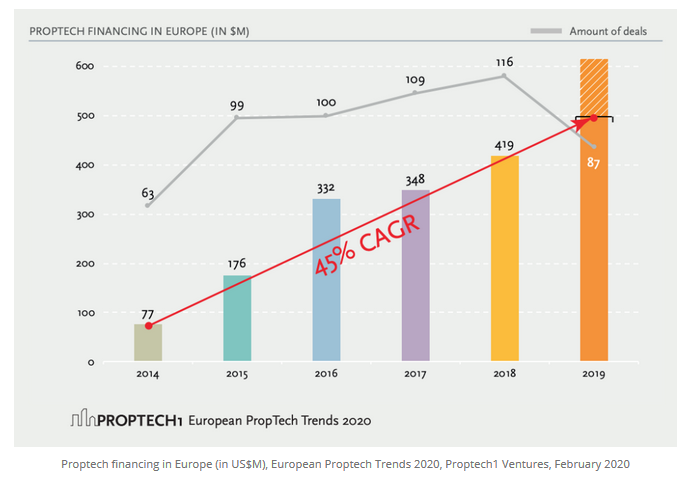

Fundraising

European companies managed to raise just under US$500 million through 87 PropTech deals in 2019. This is a record funding in volume! The decline in deals, from 2018 to 2019, is attributed to the fact that not all financing deals have been recorded this early in 2020.

The report does not give any data on the average amount of funds raised per startup. But considering that there have been 87 funding rounds in 2019 (so far), the 30 largest could be assumed to be 30% – 40% of the market, if there were still some 2019 deals to be reported at the time of publishing the report.

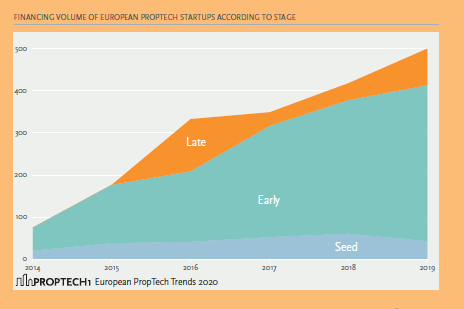

Distribution according to company stage

The amount of deal size per stage clearly shows that investors prefer investing in startups that have already proven themselves.

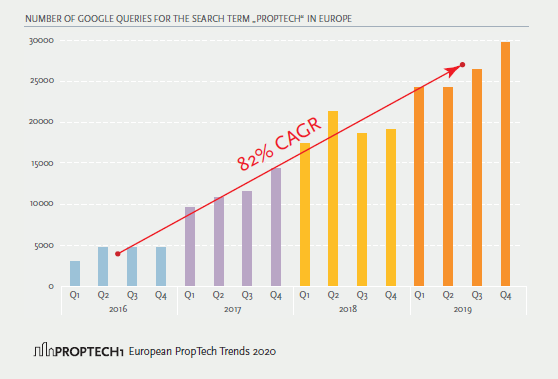

Trend Development

Apart from increased financing, there is also a steep increase in the google queries for the search term “PropTech” in Europe, indicating more interest in the sector. The report does not mention data on a relationship between increased google activity and the best funded start up list.

Top Investment Rounds

Three things stand out when assessing the Top European Investment Rounds that the report mentions:

- PropTech financing rounds have reached remarkable sizes. The record funding in the PropTech sector in Europe to date amounts to almost $100 million.

- Online brokers are over-represented. Consolidation is increasing.

- The top investment rounds are generated in the United Kingdom, Germany, Spain, and France. The 30 top invetments rounds in the report range from $98 million raised by TopHat to $13.4 million by Housell and Purple Bricks. 14 took place in the UK, 6 in Germany, 3 in Spain.

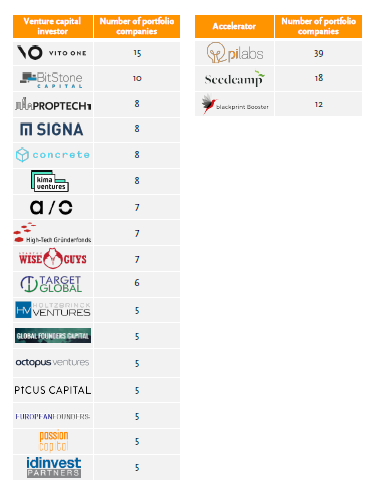

Most Active Investors

Germany has the most active PropTech Investors (8 out of 17 in the chart below), with Vito ONE, BitStone Capital and PropTech1 occupying the first, second and third place respectively. The British have the most active accelerators, with Pi Labs and Seedcamp on the first and second place.

Best Funded Start-ups

Trends

The report identifies four coming trends for 2020: “GretaTech” (sustainability), Prefab Next Gen (standardized, industrialized, modular construction), “IT Spring Cleaning” (the creation of a modern basic IT infrastructure for meaningful future big data use) and “Get Big or Get Out” (consolidation in the form of complementary mergers).

Global PropTech

Keienbergweg 95 1101 GE, Amsterdam

Telefoon: +31208965141

E-mail: info@globalproptech.online

Sitemap

Home

About Us

Membership

Our Events

News

Contact

Sign up to get invites to our events

Copyright Global Proptech Inc. All Rights Reserved

Design by REDDSTONE